1. Why 2025 is the Best Time to Develop a Fintech App?

2. Fintech App Development Cost Breakdown in 2025

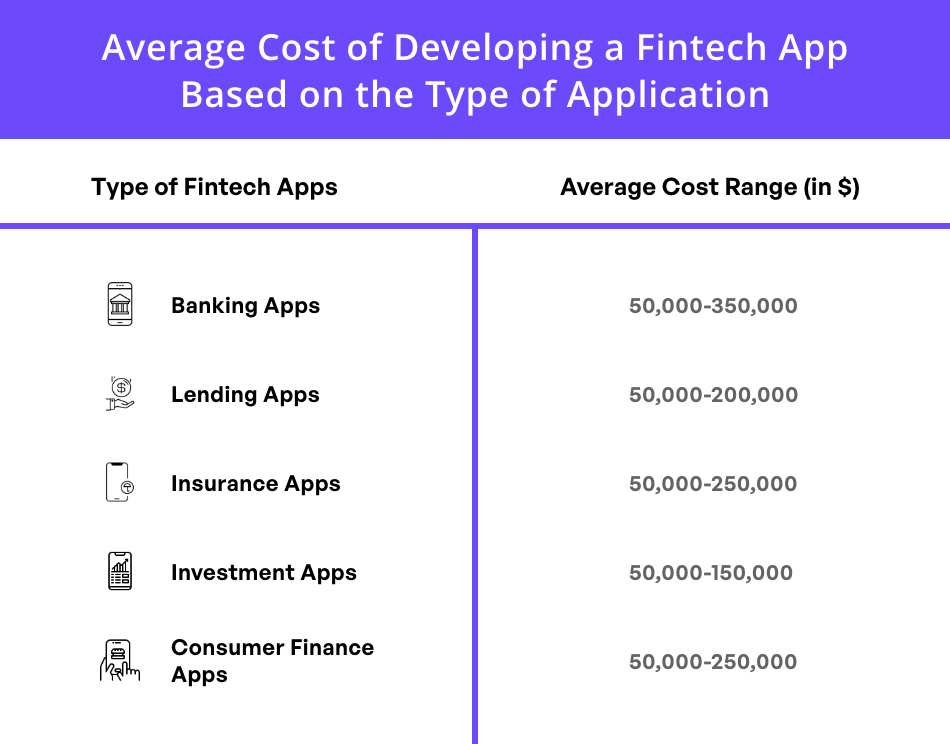

3. Fintech App Cost by Type: Banking, Lending, Insurance & More

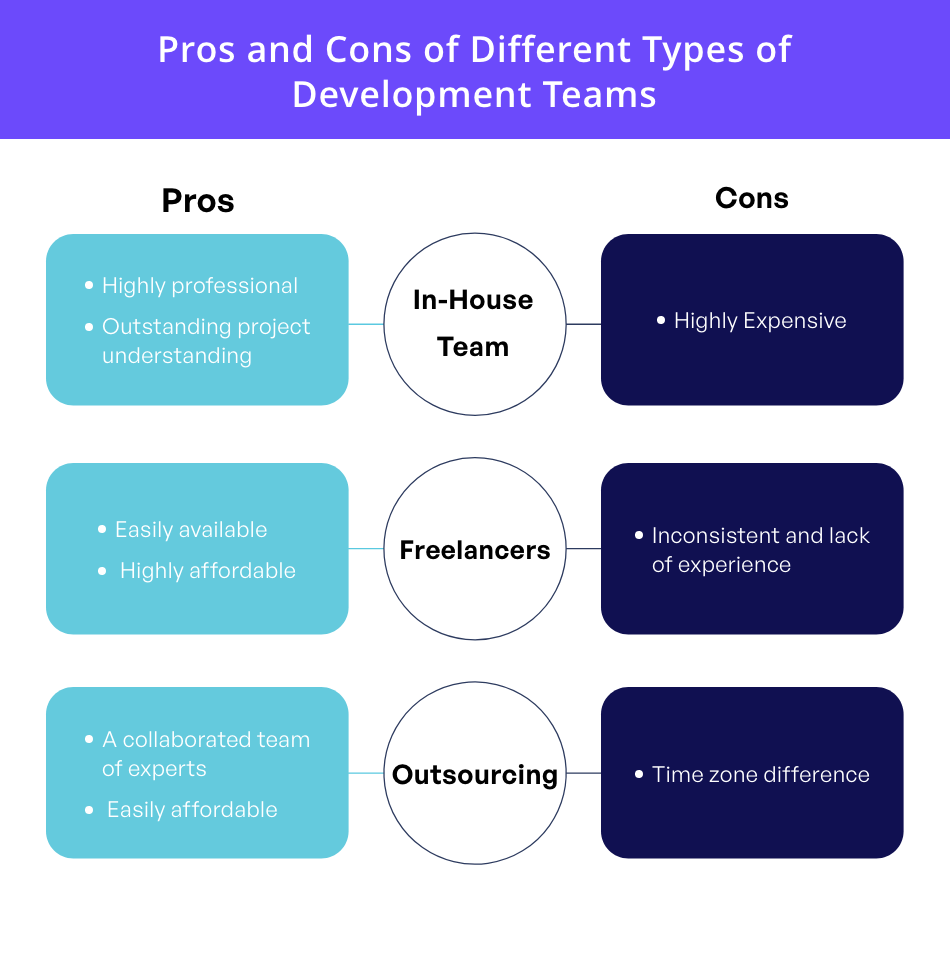

4. Fintech App Development Cost Based on the Type of Development Team

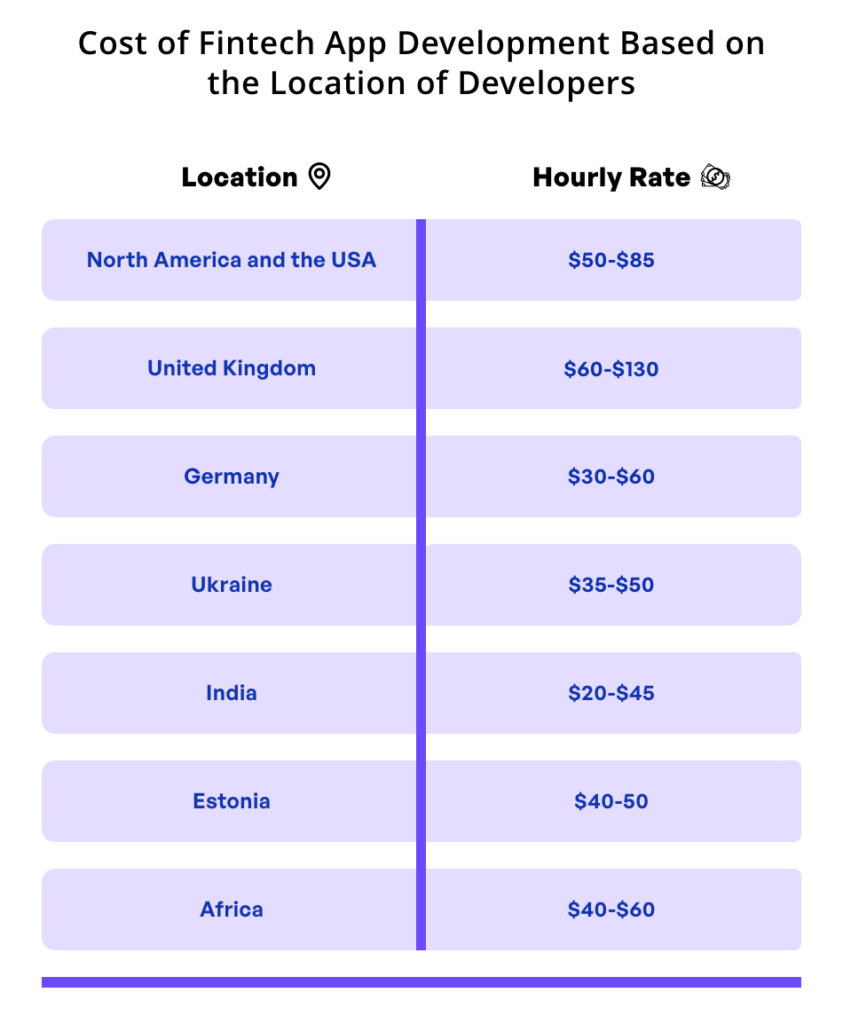

5. How Developer Location Impacts Fintech App Development Costs

6. Key Considerations Before You Start Fintech App Development

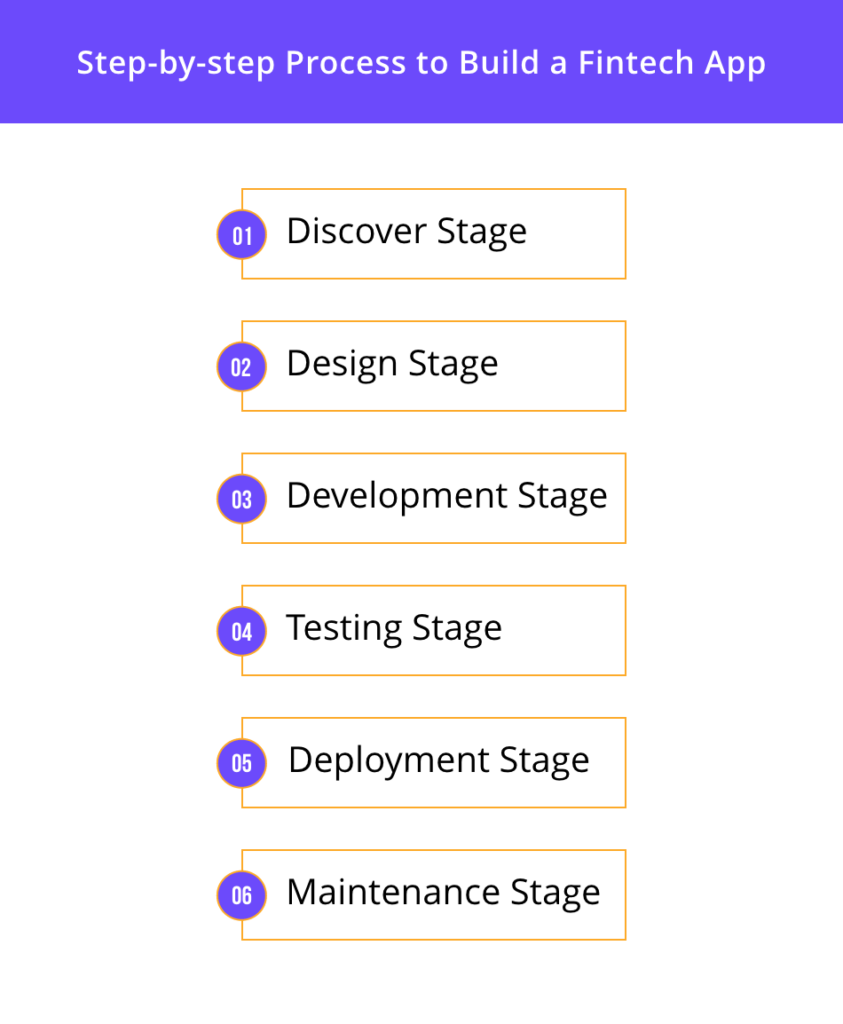

7. Fintech App Development Process: Step-by-Step Guide

8. Why Choose Appventurez for Your Fintech App Development Needs?

FAQs

English

English Arabic

Arabic

.webp)

.webp)

+1 424-408-4326

+1 424-408-4326